Shorts added at 5070NF.

ANALYSIS FOR JUNE 18:

Last week's heavy bullishness was totally dampened with today's huge news based sell off of Nifty from approx 100 DMA till the Day LEMA - and closed just below the 200 DMA implying more bearishness.

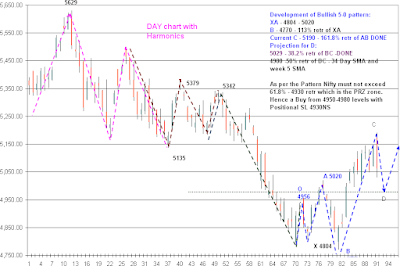

Nifty Harmonic pattern:

Development of Bullish 5-0 pattern:

XA - 4804 - 5020

B - 4770 - 113% retr of XA

Current C - 5190 - 161.8% retr of AB DONE

Projection for D:

5029 - 38.2% retr of BC -DONE

4980 -50% retr of BC - Corresponding to 20 DMA, 34 Day SMA and Week 5 SMA

As per the Pattern Nifty must not exceed 61.8% - 4930 retr which is the Potential Reversal ZONE.

Hence a Buy from 4950-4980 levels with Positional SL 4930NS

5-0 pattern in Hour Charts:

TRADE TABLE

| Trade Table | |||

| Current pattern | X-A | B | C(current) |

| 0-5 pattern and Butterfly pattern (week) | 4804 - 5020 | 4770 | 4190 |

| Trade initiated | SL 200 DMA - 5070NS | ||

| Short at 5060NF | Proj for D | ||

| 50.00% | 4980.00 | ||

| 61.80% | 4930.00 | ||

| Partbook at 4980 levels initiate 25% longs | |||

| Book Out at 4940-50 levels and initiate Longs with strict SL 4930 | |||

| CHECK LIST-DAY | |||

| CLOSE | 5064 | 5 SMA | 5099 |

| PIVOT | 5099 | 5EMA | 5082 |

| HI EMA | 5145 | 10EMA | 5053 |

| LOW EMA | 5043 | 13EMA | 5039 |

| prev HI | 5190 | 20 Hr MA | 5098 |

| prev LOW | 5042 | 50 Hr MA | 5087 |

| 50 DMA | 5067 | 100 Hr MA | 5003 |

| 200 DMA | 5067 | 200 Hr MA | 4958 |

| 100 DMA | 5196 | ||

| 20 DMA | 4980 |

No comments:

Post a Comment