| TRADE | STOPLOSS | REASON FOR Stoploss |

| Aggressive - Sold @ 6325NS/6360NF | Hour close above 6340 | Day HEMA/Hour channel breakdown |

NIFTY ANALYSIS:

Will Nifty make new highs, or is 6415 - sealed currently??? Charts gives both possibilities.

Nifty has to breakout of the Monthly Channel/weekly resistance Click Here decisively to get to new Highs.

A Bearish Wolfe wave pattern has formed in weekly charts.

The Bearish Wolfe wave pattern would be valid up to 6450-6470.

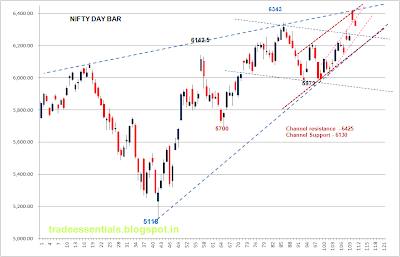

Day Chart:

Channel/Trendline resistance - 6425

Channel Support - 6130Hour Chart:

Retr for 6150 - 6415.25

38.2% - 6314

44.7% - 6296.68

50% - 6282

61.8% - 6251

78.6% - 6206

80% - 6203

88.6% - 6180

Retr for 5973 - 6415

23.6% - 631038.2% - 6246

44.7% - 6217

50% - 6194

61.8% - 6141

| TRADE | STOPLOSS | REASON FOR Stoploss |

| Aggressive - sell below 6330 NS | Hour close above 6340 | Day HEMA/Hour channel breakdown |

3 comments:

Madam

I have a query. The day close is not below DHEMA. Close is 6333 NS and DHEMA is 6322. Then how can we sell ? Am I missing something. Please explain when time permits.

Regards,

San

@ Santhosh,

The aggressive sell was initiated based on Hour channel breakdown @ 6330 and also as it was trading below Day HEMA.

If the close was below DHEMA, the aggressive sell initiated would have been carried forward with DAY HEMA as Stoploss. As the Close was above Day HEMA - technically it cannot be a short so squared off intraday.

Madam

So it is a intra-day trade. Whenever you say Aggressive- is it intra-day trade? Thanks.

Regards,

San

Post a Comment