Hour chart:

Day chart:

ANALYSIS FOR FEB 2:

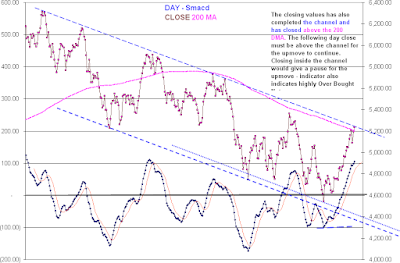

Nifty closed at 5236 above the 200 DMA. Sustaining and closing above the 200 DMA is very important for furhter upmoves - as it has tested the Long term trendline/channel at the High of 5245.

Not only the channel joining the Highs has completed a channel, but the channel formed by closing values also has completed a channel.

The day close during the following sessions must close above the channel for futher upmoves. If the closing is within the channel - then a pause is likely for the upmove.

Weekly channel resistances: (for previous chart click here)

Considering the Harmonic Pattern, the Bearish Shark Pattern of the Day TF is continuing. The initial target of the Pattern is 88.6% of OX ( i.e - 5400 - 4639) which arrives at 5313.

ALL FACTORS POINT OUT TO CONTINUED BULLISHNESS - A REASON FOR TRADERS TO BE CAUTIOUS!! A HUGE BEARISH ABCD RECIPROCAL PATTERN HAS EMERGED.

BEARISH RECIPROCAL ABCD Pattern:AB - 5177 - 5944

C - 4531- greater than 161.8% retr of AB.

As per the pattern, C must be greater then 161.8% but less than 200%

200% of AB is projected as 4410

Projected D : must be above 50% retr and below 61.8% retr of BC

50% - 5237 - achieved.

61.8% - 5404

One can expect any shorting oppurtunity from 5300 - 5400. THIS PATTERN GETS INVALIDATED ABOVE 5405 - 5410 NS.

FOR ANY LONGS CLOSE BELOW THE 200 DMA @ 5200 NS MUST BE THE STRICT STOPLOSS.

| CHECK LIST-DAY | |||

| CLOSE | 5236 | ||

| PIVOT | 5213 | 5 SMA | 5176 |

| HI EMA | 5190 | 5EMA | 5171 |

| LOW EMA | 5115 | 10EMA | 5106 |

| prev HI | 5245 | 13EMA | 5072 |

| prev LOW | 5159 | 26EMA | 4977 |

| 100 DMA | 4954 | 20 Hr MA | 5157 |

| 200 DMA | 5204 | 50 Hr MA | 5115 |

AGGRESSIVE TRADES:

BUY ABOVE 5215 NS WITH SL HOUR CLOSE BELOW PIVOT 5210/ 200 DMA 5204.

SELL BELOW 5300 WITH SL 5320NS BASED ON THE INITIAL TARGET OF THE BEARISH SHARK PATTERN.

2 comments:

Hello Satheesh

as you have been steadily gaining proficiency, your presentations are reflecting resultant sharpness.

there had been a number of technicalities to suggest a slide, yet two factors (FII inflow, and continued bullishness in the international markets) are negating the negative impact on Nifty and BN.

thanks and greetings for nice charts

very kind regards

Thanks parimal for your continouus encouragement

Post a Comment