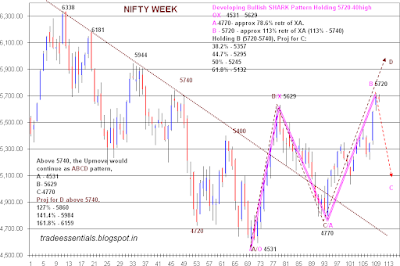

NIFTY WEEKLY CHARTS:

Developing Bullish SHARK Pattern Holding 5720-40high

OX - 4531 - 5629

A-4770- approx 78.6% retr of XA.

B - 5720 - approx 113% retr of XA (113% - 5740)

Holding B (5720-5740), Proj for C:

38.2% - 5357

44.7% - 5295

50% - 5245

61.8% - 5132

The 113% retr of the Leg 5629 - 4770 arrives at 5740. So an option of High of 5740 is still on cards. Cluster of Resistance (CLICK HERE) act in this Zone, where a Pause in upmove can be expected.

Above 5740, this pattern would be relabelled as an ABCD pattern with Projections upto 5850++

A - 4531

B- 5629

C-4770

Proj for D above 5740,

127% - 5860

141.4% - 5984

161.8% - 6159

Day Chart: CHANNEL SUPPORT 5660-50

CHANNEL RESISTANCE - 5710-15

HOUR CHARTS:

HOUR CHANNEL

Resistance - 5680-85

Support - 5645-40

SYNOPSIS:

Hold Shorts with SL 5715NS.

Aggressive Longs for Intraday can be attempted at either channel Bottom at 5640 with 10 point SL

Longs can be attempted at 5605-5610 levels based on Day LEMA with 15 Point SL 5592 being the developing Week HEMA.

| CHECK LIST-DAY | |||

| CLOSE | 5674 | HI EMA | 5666 |

| PIVOT | 5676 | LOW EMA | 5604 |

| prev HI | 5703 | 20 Hr MA | 5679 |

| prev LOW | 5652 | 50 Hr MA | 5620 |

| 5EMA | 5637 | 5 SMA | 5638 |

| 10EMA | 5570 | 10 DMA | 5563 |

| 13EMA | 5539 | 20 DMA | 5426 |

No comments:

Post a Comment