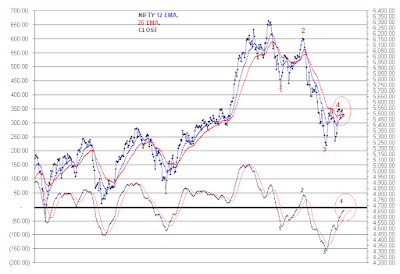

Nifty trending within channels. Has found support exactly at the channel bottom.

Bearish flag in 5min NF

Week: Nifty found support exactly at 5SMA(5411) but has closed below 5EMA 5459Day: Nifty has closed just at 21 DSMA (5444) but below 5EMA (5483)

Hour: Nifty has formed a Descending triangle and the Hr. SMACD has moved into the negative territory indicating bearinshness.

Strength: Nifty has closed above all LEMA (Hour, Day, week and Month)

Weakness: Nifty Closed Below all 5EMA's, and all Pivot points

Analysis : weakness more prevalent than strength. Strength return only after closing above pivots, 5EMA's.