Bank Nifty Futures 5 min Chart:

Breakout above today's high 10455 BNF.

DAY CHARTS 5D:

NIFTY DAY SUPPORT RESISTANCE:

BREAKOUT ABOVE 5310-20 NS

NIFTY HOUR CHART:

This blog is my trading diary. It is an attempt to organise my analysis and thoughts. I follow the charting methods given in JUST NIFTY blog by Ilango sir and so the charts would have striking resemblance to his charts. I am indebted to Ilango sir for having made this blog possible for me.

April 12, 2012

April 10, 2012

Analysis for April 10

Nifty yesterday formed a Huge red candle confirming the Bearish Baby Candle Pattern (April 9 chart ref. CLICK HERE) and closing below the Day Pivot, 5 EMA and Day HEMA. Close below the Day LEMA would lead to more downsides.

Below is the chart showing support levels of Nifty for this week

FIRST TRENDLINE SUPPORT - 5170 - 5180 - 200 DMA

TRIANGLE SUPPORT - 5100 - 5120 - 40 week MA

CHANNEL SUPPORT - 5050-5070 - 100 DMABreakdown below 5050 leads to 4950 levels -Month LEMA - 61.8% retracement for 4531 - 5629

The Bearish Shark Pattern will be invalidated below 5136 and it would form a Bullish ABCD again and would be labelled as:A-B- 5499-5136

C - 5379 - 61.8% OF AB

Proj for D:

113% - 5104

127% - 5070

161.8% - 4985

THE PROJECTIONS FOR D COINCIDES WITH THE SUPPORT LEVELS PROVIDED IN THE DAY CHART ABOVE.

AS THE HOUR IS OVERSOLD THERE MIGHT BE A BOUNCE FROM THE SUPPORT LEVELS OF 5180 -5200 INITIALLY OR THE 200 DMA -5151.

SO AN AGRESSIVE BUY CAN BE GENERATED AT THESE LEVELS WITH STRICT SL BELOW 200 DMA 5151.

Below is the chart showing support levels of Nifty for this week

FIRST TRENDLINE SUPPORT - 5170 - 5180 - 200 DMA

TRIANGLE SUPPORT - 5100 - 5120 - 40 week MA

CHANNEL SUPPORT - 5050-5070 - 100 DMABreakdown below 5050 leads to 4950 levels -Month LEMA - 61.8% retracement for 4531 - 5629

The Bearish Shark Pattern will be invalidated below 5136 and it would form a Bullish ABCD again and would be labelled as:A-B- 5499-5136

C - 5379 - 61.8% OF AB

Proj for D:

113% - 5104

127% - 5070

161.8% - 4985

THE PROJECTIONS FOR D COINCIDES WITH THE SUPPORT LEVELS PROVIDED IN THE DAY CHART ABOVE.

AS THE HOUR IS OVERSOLD THERE MIGHT BE A BOUNCE FROM THE SUPPORT LEVELS OF 5180 -5200 INITIALLY OR THE 200 DMA -5151.

SO AN AGRESSIVE BUY CAN BE GENERATED AT THESE LEVELS WITH STRICT SL BELOW 200 DMA 5151.

| CHECK LIST-DAY | |||

| CLOSE | 5234 | 5 SMA | 5306 |

| PIVOT | 5250 | 5EMA | 5282 |

| HI EMA | 5314 | 10EMA | 5281 |

| LOW EMA | 5231 | 13EMA | 5284 |

| prev HI | 5288 | 26DEMA | 5292 |

| prev LOW | 5228 | 10 DMA | 5261 |

| 100 DMA | 5079 | 100 Hr MA | 5270 |

| 200 DMA | 5151 | 200 Hr MA | 5312 |

April 9, 2012

ANALYSIS FOR APR 9

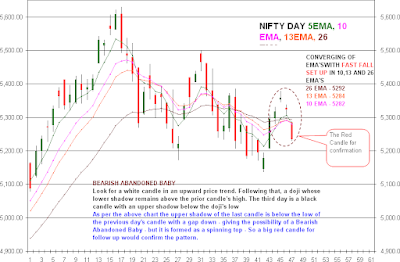

Nifty has closed just near the Day Pivot and week Pivot. Nifty has formed an Bearish abandoned Baby pattern.

BEARISH ABANDONED BABY -

Look for a white candle in an upward price trend. Following that, a doji whose lower shadow remains above the prior candle’s high. The third day is a black candle with an upper shadow below the doji’s low

As per the above chart the upper shadow of the last candle is below the low of the previous day's candle with a gap down - giving the possibility of a Bearish Abandoned Baby - but it is formed as a spinning top - So a big red candle for follow up would confirm the pattern.

Nifty Has managed to close just at the Day 5EMA. The 10,13 AND 26 EMA'S are Bearishly alligned with a Possible Fast Fall set up. A Close below the Day 5 EMA would call for weakness.

Harmonic Patterns:

After completing a Bullish ABCD pattern in Hour Charts at 5136 - a 61.8% retracement is done to reach 5379. If Nifty manges to get thro 5380 - breakout above the Day channel and trendline resistance of Hour Charts then the Bearish Shark Pattern (ref chart Mar 23 CLICK HERE) would come into play for much higher targets upto 5550++.

The Long term channel (ref chart March 23 Click here) has given good supports at 5136 lows, and has reached 5379. A Breakout above this is very much required for a good upmove.

SYNOPSIS: A move above 5380 - corresponding to week Hema would Lead to good upmoves. Day/Week close below 5225 would lead to weakness.

Trading Time between 5380 and 5220.

BEARISH ABANDONED BABY -

Look for a white candle in an upward price trend. Following that, a doji whose lower shadow remains above the prior candle’s high. The third day is a black candle with an upper shadow below the doji’s low

As per the above chart the upper shadow of the last candle is below the low of the previous day's candle with a gap down - giving the possibility of a Bearish Abandoned Baby - but it is formed as a spinning top - So a big red candle for follow up would confirm the pattern.

Nifty Has managed to close just at the Day 5EMA. The 10,13 AND 26 EMA'S are Bearishly alligned with a Possible Fast Fall set up. A Close below the Day 5 EMA would call for weakness.

Harmonic Patterns:

After completing a Bullish ABCD pattern in Hour Charts at 5136 - a 61.8% retracement is done to reach 5379. If Nifty manges to get thro 5380 - breakout above the Day channel and trendline resistance of Hour Charts then the Bearish Shark Pattern (ref chart Mar 23 CLICK HERE) would come into play for much higher targets upto 5550++.

The Long term channel (ref chart March 23 Click here) has given good supports at 5136 lows, and has reached 5379. A Breakout above this is very much required for a good upmove.

WEEK CHART:SYNOPSIS: A move above 5380 - corresponding to week Hema would Lead to good upmoves. Day/Week close below 5225 would lead to weakness.

Trading Time between 5380 and 5220.

| Week levels | Month Levels | ||

| CLOSE | 5323 | CLOSE | 5296 |

| PIVOT | 5327 | PIVOT | 5310 |

| HI EMA | 5386 | HI EMA | 5434 |

| LOW EMA | 5227 | LOW EMA | 4940 |

| 5 EMA | 5315 | 5 EMA | 5201 |

| 5 SMA | 5310 | 3 EMA | 5247 |

| PrevHigh | 5379 | High | 5499 |

| Prev Low | 5279 | LOW | 5136 |

| CHECK LIST-DAY | |||

| CLOSE | 5323 | 5 SMA | 5295 |

| PIVOT | 5322 | 5EMA | 5306 |

| HI EMA | 5327 | 10EMA | 5291 |

| LOW EMA | 5274 | 13EMA | 5292 |

| prev HI | 5338 | 26DEMA | 5297 |

| prev LOW | 5305 | 100 Hr MA | 5279 |

| 50 DMA | 5324 | 200 Hr MA | 5320 |

| 20DMA | 5300 |