TATAMOTORS:

ICICI BANK :

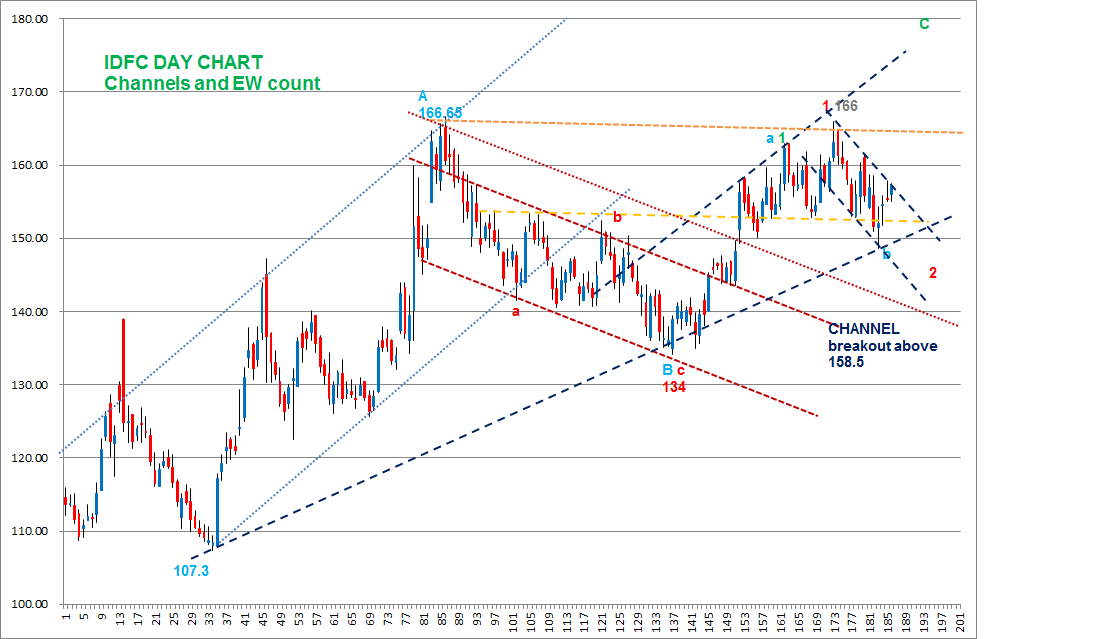

IDFC:

This blog is my trading diary. It is an attempt to organise my analysis and thoughts. I follow the charting methods given in JUST NIFTY blog by Ilango sir and so the charts would have striking resemblance to his charts. I am indebted to Ilango sir for having made this blog possible for me.

December 23, 2014

December 22, 2014

July 24, 2014

TATAMOTORS ANALYSIS

TATAMOTORS UPDATE HOUR CHART 25 JULY:

Tatamotors found short term support at 470 (Click Here) - and has moved up to 488.2 - and reigning at 484 levels.

HOUR CHART:

Tatamotors found short term support at 470 (Click Here) - and has moved up to 488.2 - and reigning at 484 levels.

HOUR CHART:

Channel

Resistance @ 490 - Breakout above 490 - requires at

least 2Hours Close above 490

Channel

Support @ 480 - breakdown below 480 -

corresponding to 5DMA. An EOD close

below 480 - would initially drag towards -468 - 10 DMA

DAY CHART:

A

WOLFE WAVE IS FORMED at the CHANNEL RESISTANCE

1,2,3,4 &5.

This would be negated with an EOD

close above 490.

An EOD close below 5DMA 479 would

be the initial trigger point.

WEEK CHARTS:

MONTH CHART:

490 - 480 is the decider level for further Upmoves or downmoves.

A Bullish Shark Pattern has developed in day Charts which would also be negated above 491.

Development

of Bullish Shark Pattern:

OX - 429-484.7

A - 442.6 - 78.6% retracement

B - 88.2 - approx 113% retr of XA

Proj for C:

61.8% - 460.02

78.6% - 452.36

88.6% - 447.8

113% - 436.67 - This also coincides

with 88.6% of OX.

Synopsis:

An EOD close above 490 - Bullish. An EOD close Below 479 - Bearish.

July 18, 2014

SAIL ANALYSIS

FOR TATAMOTORS ANALYSIS CLICK HERE:

From the High of 112.9, Sail has reached 81 levels below 5DMA currently trading at 85-88 range. Yesterday it reached 88 - 10 DMA but has not closed above it. Today's 10 DMA is 87.1.

From the High of 112.9, Sail has reached 81 levels below 5DMA currently trading at 85-88 range. Yesterday it reached 88 - 10 DMA but has not closed above it. Today's 10 DMA is 87.1.

TATA MOTORS ANALYSIS

For SAIL analysis Click HERE:

Tatamotors Found support at 440 levels @ 50 DMA and bounced back again upto 477 knocking at the Medium term Weekly Channel. Breakout above 485 -487 would lead to new Highs. Resisting at 480 levels would drag it back to 460 levels. Breakdown of 460 levels is highly Bearish.

Tatamotors Found support at 440 levels @ 50 DMA and bounced back again upto 477 knocking at the Medium term Weekly Channel. Breakout above 485 -487 would lead to new Highs. Resisting at 480 levels would drag it back to 460 levels. Breakdown of 460 levels is highly Bearish.

July 4, 2014

TATAMOTOR ANALYSIS

Tatamotors has reached the Initial - Medium term Resistance level of 472 - yesterday's High as per weekly charts. Next major resistance would be 480-485.

If resisted at 472 - then 460-456 Week HEMA would be tested

If breakout above 472 - then it would lead to 480 -485-490.

If resisted at 472 - then 460-456 Week HEMA would be tested

If breakout above 472 - then it would lead to 480 -485-490.

July 2, 2014

TATAMOTORS ANALYSIS

Diamond Pattern has given a breakout with huge volumes. This Breakout would sustain Holding 445. Below 445 - it would fall within the diamond again.

June 23, 2014

TATAMOTORS ANALYSIS

Tatamotors is poised Mid-way between Breakout and Break Down.

As per Weekly TF and Day TF - Holding 423-424 - Weekly Lema and Channel Bottom is very important for it to move towards 450, above it 470++.

As per Hour charts Consoildation is taking place - Breakout 441 - would lead to 450, and Breakdown below 432 leads to 423-424.

THE KEY SUPPORT IS 422-424. It would be a Low risk High Reward entry to buy near 423-424 levels with 420-417 as SL.

As per Weekly TF and Day TF - Holding 423-424 - Weekly Lema and Channel Bottom is very important for it to move towards 450, above it 470++.

As per Hour charts Consoildation is taking place - Breakout 441 - would lead to 450, and Breakdown below 432 leads to 423-424.

THE KEY SUPPORT IS 422-424. It would be a Low risk High Reward entry to buy near 423-424 levels with 420-417 as SL.

June 20, 2014

TATAMOTOR ANAYLSIS

Tatamotors is consolidating within a Contracting triangle in Hour charts and Symmetrical triangle -(Diamond Pattern) in Day charts. Breakdown of triangle below 430. Triangle resistance 450. Breakout of triangle above 450+.

5 DMA - 436.35

10 DMA - 441.8

20 DMA - 434.85

Fast

rise possibility between 5 and 20 DMA.

Holding

EOD above 5 DMA is required for upmove.

DIAMOND PATTERN breakout above 450 and breakdown below 430.

HOLDING ABOVE 430 - INITIALLY UPTO 450 AND BREAKOUT ABOVE 450 TOWARDS 460++

BREAKDOWN BELOW 430 - DRAG DOWN TOWARDS 420-415.

May 22, 2014

TATAMOTORS ANALYSIS

Tatamotors brokedown below 443 - 5DMA and has reached 10 DMa near 434-436 levels.

If supported at 434 - expanding triangle of Day charts and Falling wedge of Hour charts, then a good upmove upto 465++ on breakout above 439-440.

Breakdown of 434 - would drag upto 420-416 - 50 DMA levels coinciding with channel bottom of Day charts.

EW count supports both.

If supported at 434 - expanding triangle of Day charts and Falling wedge of Hour charts, then a good upmove upto 465++ on breakout above 439-440.

Breakdown of 434 - would drag upto 420-416 - 50 DMA levels coinciding with channel bottom of Day charts.

EW count supports both.

SYNOPSIS: Holding yesterday's low of 434, and if today opens above 436 - It is Low Risk High reward entry.

Positional Trade - Hold longs with Sl 434 EOD.

Aggressive Sell - Sell below 434 on Hourly close basis - with SL Hour close above 436.

May 20, 2014

TATAMOTORS ANALYSIS

It has just closed just above the crucial 5 DMA.

A Bullish Wolfe Wave has formed in Hour Charts - but it will be effective if 5DMA is held EOD.

A Bullish Wolfe Wave has formed in Hour Charts - but it will be effective if 5DMA is held EOD.

May 19, 2014

Tatamotor Analysis

WEEKLY CHARTS have given a breakout.

May 5, 2014

TATAMOTOR ANALYSIS

FOR NIFTY ANALYSIS CLICK HERE

Tatamotors made a High of 337 and has had a pull back up to 404 - 50 DMA.

It is trading between 50 DMA and 10 DMAduring the past week.

Trading above 414-415 - 5 DMA and an EOD close above 5DMA would give a runup towards 10 DMA again.

Failing to close below 5DMA - would drag tatamotors near 404-405 50 DMA again.

A Bearish Wolfe Wave has formed in Day Charts which would be invalidated on an EOD close above 10 DMA 420-422.

Tatamotors made a High of 337 and has had a pull back up to 404 - 50 DMA.

It is trading between 50 DMA and 10 DMAduring the past week.

Trading above 414-415 - 5 DMA and an EOD close above 5DMA would give a runup towards 10 DMA again.

Failing to close below 5DMA - would drag tatamotors near 404-405 50 DMA again.

A Bearish Wolfe Wave has formed in Day Charts which would be invalidated on an EOD close above 10 DMA 420-422.

NIFTY ANALYSIS

FOR TATAMOTORS ANALYSIS CLICK HERE

NIFTY ANALYSIS:

Nifty has made a Life time high and has done a Pull back of almost 200 points.

Nifty has closed below all parameters in day TF. The Day TF charts have been consistently exhibiting -ve divergences.

Hour charts are reaching the Over Sold area - and the channel breakout is above 6710 - Day LEMA. An EOD CLOSE above the Day LEMA would put a pause to the down movement.

NIFTY ANALYSIS:

Nifty has made a Life time high and has done a Pull back of almost 200 points.

| DATE | HIGH | LOW | CLOSE | 5 EMA | 10 EMA |

| 25-Apr-14 | 6870 | 6773 | 6783 | 6796 | 6774 |

| 28-Apr-14 | 6786 | 6750 | 6761 | 6785 | 6772 |

| 29-Apr-14 | 6780 | 6709 | 6715 | 6762 | 6762 |

| 30-Apr-14 | 6780 | 6657 | 6696 | 6740 | 6750 |

| 2-May-14 | 6738 | 6690 | 6695 | 6725 | 6740 |

| 5 DMA | 10 DMA | HIGH EMA | LOW EMA |

| 6807 | 6781 | 6841 | 6775 |

| 6804 | 6778 | 6823 | 6766 |

| 6783 | 6770 | 6808 | 6747 |

| 6759 | 6762 | 6799 | 6717 |

| 6730 | 6758 | 6779 | 6708 |

Nifty has closed below all parameters in day TF. The Day TF charts have been consistently exhibiting -ve divergences.

Hour charts are reaching the Over Sold area - and the channel breakout is above 6710 - Day LEMA. An EOD CLOSE above the Day LEMA would put a pause to the down movement.

March 14, 2014

TATAMOTOR ANALYSIS

Tatamotors broke below 404 - to reach 383 today -with almost a 5 wave complete.

Holding 383 rather 382.7 - upsides possible - initially upto 404-406 breakout of this would lead to new Highs.

Breakdown of 382 - more lows towards 50DMA/100 DMA @ 378 levels.

Holding 383 rather 382.7 - upsides possible - initially upto 404-406 breakout of this would lead to new Highs.

Breakdown of 382 - more lows towards 50DMA/100 DMA @ 378 levels.

Holding 383 - new Highs possible. - Bullish Count i,ii,iii,iv

Breakout of wedge @ 390

Breakdown below 382.7 - confirms more downside towards B

Breakout above 390

holding 382.7 is a must for an

upmove.

March 11, 2014

Tatamotors analysis

With the Low pf 393 - the down C is almost done. (click here) Holding 393 - another round of High is Possible.

Break down of 393 - would lead to more downsides -

Breakout above 404-405 would be a Falling wedge breakout. 405-406 - corresponding to 10 DMA.

EOD close above 10 DMA would be bullish and if withheld - then a swift upmove towards 420-425-430.

393 - CRUCIAL LEVEL

Break down of 393 - would lead to more downsides -

Breakout above 404-405 would be a Falling wedge breakout. 405-406 - corresponding to 10 DMA.

EOD close above 10 DMA would be bullish and if withheld - then a swift upmove towards 420-425-430.

393 - CRUCIAL LEVEL

March 7, 2014

TATAMOTORS ANALYSIS

Intraday Update 12.15 PM:

416 target almost achieved after the breakout above 410.

TATAMOTORS ANALYSIS:

A Bullish Wolfe Wave has formed - expecting point 5 near 404.

Holding 404 - another High upto 416-420 possible.

This would render the Daimond Pattern as a continuation pattern and not a reversal pattern. Diamond Breakout is above 410.

Breakdown below 404 - Diamond Pattern targets are 400-396

416 target almost achieved after the breakout above 410.

Bearish

Count: V over at 420, a @ 404, b now @ 415.85 and down towards c near 400-396

levels.

Bullish

Count : a.v - 420 , b.v - 404 and now towards c.vTATAMOTORS ANALYSIS:

A Bullish Wolfe Wave has formed - expecting point 5 near 404.

Holding 404 - another High upto 416-420 possible.

This would render the Daimond Pattern as a continuation pattern and not a reversal pattern. Diamond Breakout is above 410.

Breakdown below 404 - Diamond Pattern targets are 400-396

March 6, 2014

TATAMOTORS ANALYSIS

Tatamotors Update 12.00noon:

TATAMOTOR ANALYSIS:

A diamond pattern has formed in Tatamotor Hour charts.

Breakdown below 407.3 - targets 398-96

Breakout above 413 - targets - 421-424

TATAMOTOR ANALYSIS:

A diamond pattern has formed in Tatamotor Hour charts.

Breakdown below 407.3 - targets 398-96

Breakout above 413 - targets - 421-424

March 5, 2014

TATAMOTORS UPDATE

Tatamotors made a high of 420 yesterday - with a possibility of completion of a 5 wave structure in Hou charts.

Bearish Possibility:

5th wave completed at 420 and the correction has started. Break of 408 or rather break of 405 would confirm a correction.

Bearish Possibility:

5th wave completed at 420 and the correction has started. Break of 408 or rather break of 405 would confirm a correction.

March 3, 2014

NIFTY and TATAMOTORS ANALYSIS

Nifty made a High of 6282 on Friday but closed below the Month Hema and crucial resistance level of 6290-6300.

Resistance at 6280-90.

Support at 6180-90 - 50 DMA.

If supported quick move towards 6300++

Breakdown below 6180 - 50 DMA and EOD close below it is very bearish - likely to lead below 6100 levels.

Resistance at 6280-90.

Support at 6180-90 - 50 DMA.

If supported quick move towards 6300++

Breakdown below 6180 - 50 DMA and EOD close below it is very bearish - likely to lead below 6100 levels.

February 28, 2014

TATAMOTOR analysis

Tatamotors has made a NEW HIGH of 418.2 - with a possibility of completion of 5waves in week charts.

NIFTY ANALYSIS

Today being the End of Month and End of Week - the crucial levels are 6290 - Month HEMA. 6197 - Week HEMA.

Monthly Charts Resistances - 6290-6320

Weekly chart Channel resistances - 6240-6250.

Day chart Channel resistances - 6240-6250

Day Chart Channel Supports - 6180.

Hour charts SMACD and KST consistently exhibiting -ve divergences.

Monthly Charts Resistances - 6290-6320

Weekly chart Channel resistances - 6240-6250.

Day chart Channel resistances - 6240-6250

Day Chart Channel Supports - 6180.

Hour charts SMACD and KST consistently exhibiting -ve divergences.

February 25, 2014

Nifty Analysis

intraday Update 12.30PM:

Tatamotors Hour chart update:

395 - has been knocked thrice today. Breakdown of wedge below 394. If supported then again towards 400+

Tatamotors Hour chart update:

395 - has been knocked thrice today. Breakdown of wedge below 394. If supported then again towards 400+

February 24, 2014

NIFTY and TATAMOTORS analysis

Tatamotors has rallied upto 400.85 (current value) gathering support at 390 levels. A rising wedge is formed and breakdown of Wedge is below 394.

February 21, 2014

NIFTY ANALYSIS and TATAMOTORS ANALYSIS

Nifty found support from the 200DMA @5971 and has rallied upto 6160 and has closed below the Day HEMA thereby indicating sell on rise.

A 5-0 pattern is almost complete in day charts @6160. This Pattern would be invalid above 6194 - 61.8% retracement of 6358 - 5933.

February 20, 2014

TATA MOTORS ANALYSIS

UPDATE 1.00 pm:

Hour chart with EW count:

If 390-388 is held then a swift upmove to 395++.If breaks down 390 then down to 380,375.

Hour chart with EW count:

If 390-388 is held then a swift upmove to 395++.If breaks down 390 then down to 380,375.

February 13, 2014

Tatamotors analysis

Channel Breakdown below 378. If supported then again towards 385.

Tatamotors Analysis:

Tatamotors made a High of 383 yesterday - thereby reaching the channel resistance of weekly and Day charts.

Breakout above 383 - Channel breakout would be bullish.

February 10, 2014

TATAMOTORS ANALYSIS

Tatamotors Pre Market:

Tatamotors has closed exactly at a crucial level of 360 - as per charts. Breakout above 361 - would swiftly lead to 370-374. Breakdown below 360 would drag it to 348 - 345. Today being the Quaterly result of Tatamotors it would play a major role.

Tatamotors has closed exactly at a crucial level of 360 - as per charts. Breakout above 361 - would swiftly lead to 370-374. Breakdown below 360 would drag it to 348 - 345. Today being the Quaterly result of Tatamotors it would play a major role.

February 7, 2014

TATAMOTORS ANALYSIS

Tatamotors has closed above 10 DMA and if 360-362 resistance is surpassed it would target 50 DMA - near 370 levels.

February 6, 2014

Tatamotors Analysis

INTRADAY UPDATE 10.40 AM:

Morning reached 360 and has fallen. If it is

the 4th wave completed then again a pullback - break of the channel below 348

would lead to more lows - as Start of C

February 5, 2014

Tatamotors and Nifty analysis

Tatamotors found support at 200 DMA and bounced back upto 345.

Hour Channel and Day Wedge Breakout above 346.

Hour Channel and Day Wedge Breakout above 346.

February 4, 2014

Tatamotors analysis

By breaking 337 - the possibility of 5th wave has gone. Below 336 - next major support as per monthly/weekly charts are 330-325.

February 3, 2014

TATAMOTORS ANALYSIS

Tatamotors has closed on a weak note on Friday but it is almost at the support zone too.

Break of 349 - indicates weakness and likely to drag it towards 340. 340-338 major support levels as per weekly charts. Till 338 holds the possibility of 5th wave exists as per weekly/day charts.

Break of 349 - indicates weakness and likely to drag it towards 340. 340-338 major support levels as per weekly charts. Till 338 holds the possibility of 5th wave exists as per weekly/day charts.